Hours of Operation:

Monday Through Friday 9:00 am to 5:00 pm EST

Closed Weekends/Holidays

(919)689-6565

mike@trianglelifeandhealth.com

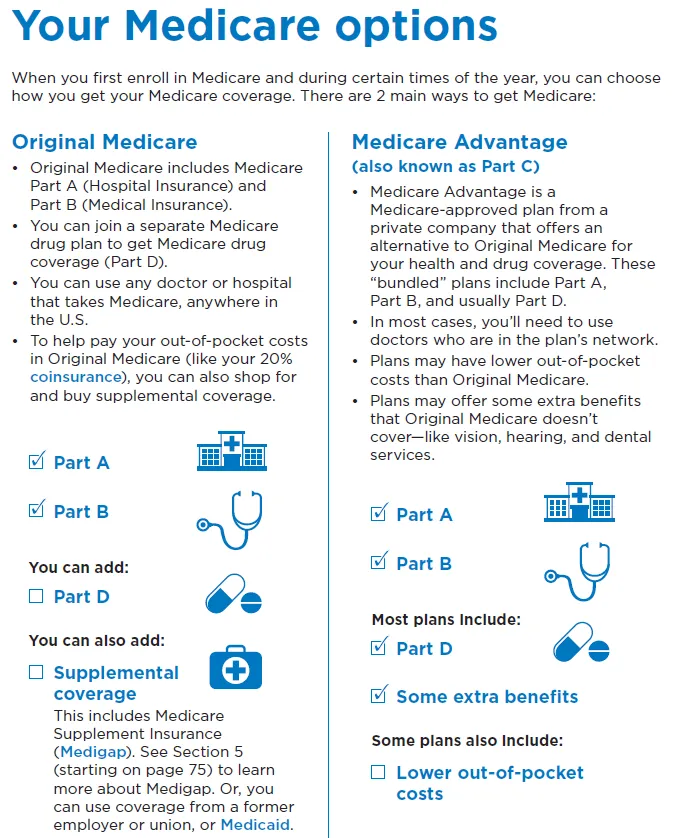

One Stop for Every Choice!

With access to over 30 Insurance Companies and 100+ Medicare Plans we have every option on the market! Our partnerships allow us to offer virtually every plan at the absolute lowest price as well!

One Stop for Every Choice!

With access to over 30 Insurance Companies and 100+ Medicare Plans we have every option on the market! Our partnerships allow us to offer virtually every plan at the absolute lowest price as well!

Get a complimentary 15 minute consultation.

Our comprehensive review includes shopping for drug prices, lower premiums, better networks, and more!

Financial help for those you leave behind..

We've helped thousands of seniors with their final expense planning. Every person we meet has the same two goals in mind for their estate:

#1. Nobody wants to be a burden on their family.

#2. Everyone would like a respectable burial.

With these two factors in mind, we compare 30+ Life Insurance companies that specialize in Final Expense products to find you an affordable rate and an acceptable amount of coverage.

Financial help for those you leave behind..

We've helped thousands of seniors with their final expense planning. Every person we meet has the same two goals in mind for their estate:

#1. Nobody wants to be a burden on their family.

#2. Everyone would like a respectable burial.

With these two factors in mind, we compare 30+ Life Insurance companies that specialize in Final Expense products to find you an affordable rate and an acceptable amount of coverage.

$11,618.00

Average End of Life Cost in 2026

18% to 40%

In 2026 $12.6 million dollars in estate taxes will be paid.

$4,731.00

2026 Average Medical Care Costs in the last year of life.

$11,618.00

Average End of Life Cost in 2026

18% to 40%

In 2026 $12.6 million dollars in estate taxes will be paid.

$4,731.00

2026 Average Medical Care Costs in the last year of life.

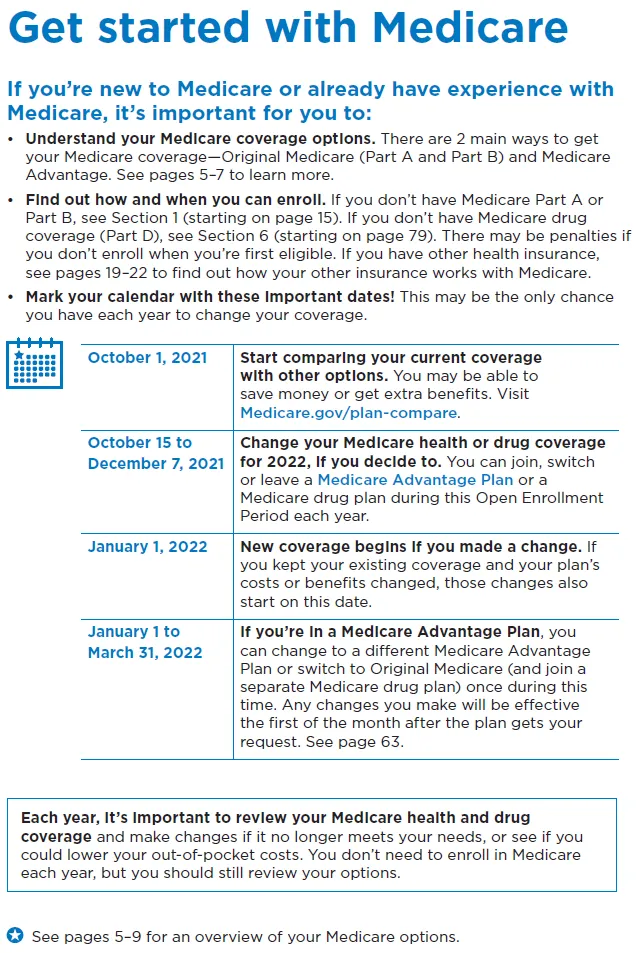

Don't be caught off guard by unexpected medical bills..

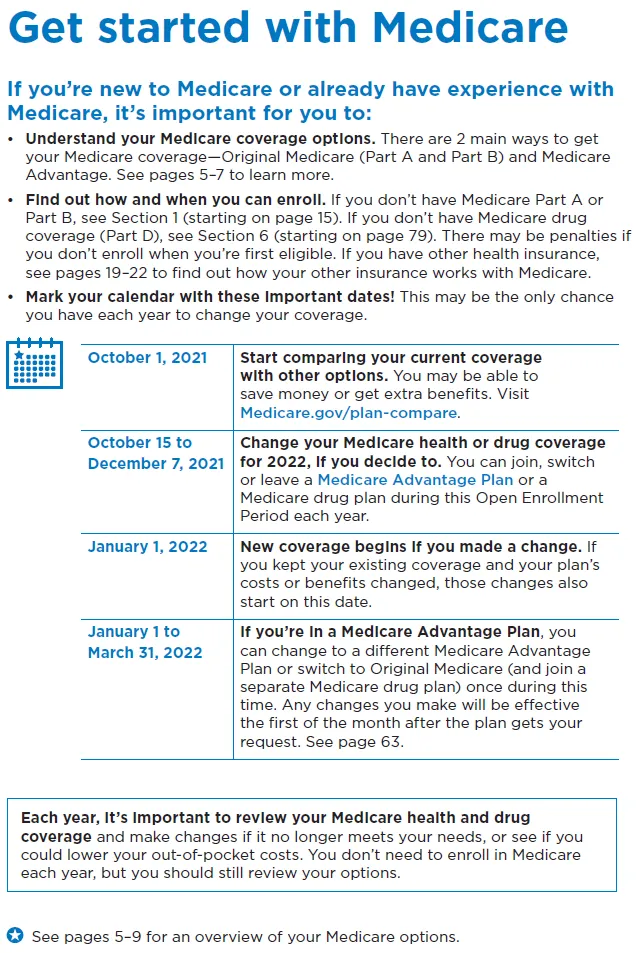

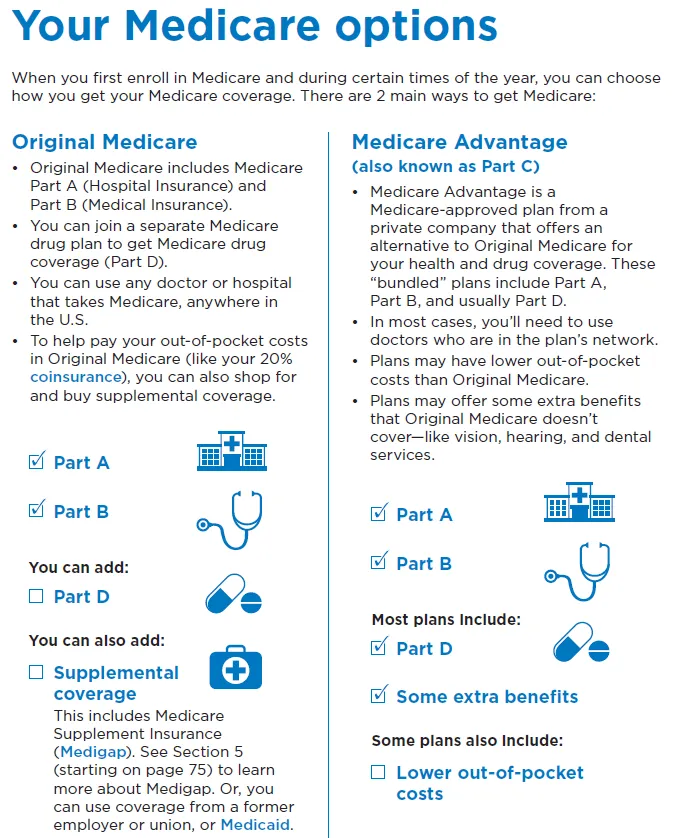

In 2026 42% of Americans on Medicare have what's called a Medicare Advantage Plan. However, what many may not realize is that a hospitalization, skilled nursing stay, or outpatient surgery may result in costly medical bills.

Fortunately! There is a way to supplement your Medicare Advantage Plan and cover those unexpected expenses for pennies on the dollar! Not with a Medicare Supplement like you would have with Part A and Part B, but with a special policy designed for Medicare Advantage called a Hospital Indemnity Plan.

What can a Hospital Indemnity Plan cover?

- Daily Hospital Confinement Copays

- Ambulance and Emergency Room Copays

- Maximum Out-of-Pocket for Cancer Treatment

- Dental and Vision Copays and Coinsurance

- Short Duration Hospital Stay Copays

- Outpatient Surgery Copays

- Skilled Nursing Facility Daily Copays

- Payouts for Critical Accidents, Fractures, etc.

- Occupational Therapy Copays

Example:

65 y/o Female (TX)

$1,500.00 Hospital Copay

$250.00 Ambulance Copay

$90.00 Emergency Room Copay

Actual Quote:

$25.55 Per Month

100% Covered

100% Covered

100% Covered

Don't be caught off guard by unexpected medical bills..

In 2026 42% of Americans on Medicare have what's called a Medicare Advantage Plan. However, what many may not realize is that a hospitalization, skilled nursing stay, or outpatient surgery may result in costly medical bills.

Fortunately! There is a way to supplement your Medicare Advantage Plan and cover those unexpected expenses for pennies on the dollar! Not with a Medicare Supplement like you would have with Part A and Part B, but with a special policy designed for Medicare Advantage called a Hospital Indemnity Plan.

What can a Hospital Indemnity Plan cover?

- Daily Hospital Confinement Copays

- Ambulance and Emergency Room Copays

- Maximum Out-of-Pocket for Cancer Treatment

- Dental and Vision Copays and Coinsurance

- Short Duration Hospital Stay Copays

- Outpatient Surgery Copays

- Skilled Nursing Facility Daily Copays

- Payouts for Critical Accidents, Fractures, etc.

- Occupational Therapy Copays

Example:

65 y/o Female (TX)

$1,500.00 Hospital Copay

$250.00 Ambulance Copay

$90.00 Emergency Room Copay

Actual Quote:

$25.55 Per Month

100% Covered

100% Covered

100% Covered

Retirement Income you can never outlive!

10/24/2014

“As boomers approach retirement and life expectancies increase, income annuities can be an important planning tool for a secure retirement. The Treasury is working to expand the availability of retirement income options for working families. By encouraging the use of income annuities, today’s guidance can help retirees protect themselves from outliving their savings.”

-J. Mark Iwry, Senior Advisor to the Secretary of the Treasury and Deputy Assistant Secretary for Retirement and Health Policy.

Do you have retirement investments in the marketplace? Are you concerned that you will lose money prior to retiring that you will not have time to recoup? Are you worried that you will outlive your retirement income? If you answered yes to these questions, an Indexed Annuity may be right for you! What is an Annuity you ask? Well, in layman's terms, it's an Individual Retirement Account issued by an insurance company.

An indexed annuity is a type of annuity contract that pays an interest rate based on the performance of a specified market index, such as the S&P 500. It differs from fixed annuities, which pay a fixed rate of interest, and variable annuities, which base their interest rate on a portfolio of securities chosen by the annuity owner. Indexed annuities are often referred to as equity-indexed or fixed-indexed annuities.

Indexed annuities offer their owners, or annuitants, the opportunity to earn higher yields than fixed annuities when the financial markets perform well. Typically, they also provide strong protection against market declines. While indexed annuities are linked to the performance of a specific index, the annuitant won't necessarily reap the full benefit of any rise in that index. One reason is that indexed annuities often set limits on the potential gain at a certain percentage, commonly referred to as the "participation rate." The participation rate can be as high as 100%, meaning the account is credited with all of the gain, or as low as 25%. Most indexed annuities offer a participation rate between 80% and 90%—at least in the early years of the contract.

Participation in the marketplace, protection from loss, and a lifetime income stream that you can never outlive. It's time to stop investing like a teenager! Speak with one of our retirement experts today!

Retirement Income you can never outlive!

10/24/2014

“As boomers approach retirement and life expectancies increase, income annuities can be an important planning tool for a secure retirement. The Treasury is working to expand the availability of retirement income options for working families. By encouraging the use of income annuities, today’s guidance can help retirees protect themselves from outliving their savings.”

-J. Mark Iwry, Senior Advisor to the Secretary of the Treasury and Deputy Assistant Secretary for Retirement and Health Policy.

Do you have retirement investments in the marketplace? Are you concerned that you will lose money prior to retiring that you will not have time to recoup? Are you worried that you will outlive your retirement income? If you answered yes to these questions, an Indexed Annuity may be right for you! What is an Annuity you ask? Well, in layman's terms, it's an Individual Retirement Account issued by an insurance company.

An indexed annuity is a type of annuity contract that pays an interest rate based on the performance of a specified market index, such as the S&P 500. It differs from fixed annuities, which pay a fixed rate of interest, and variable annuities, which base their interest rate on a portfolio of securities chosen by the annuity owner. Indexed annuities are often referred to as equity-indexed or fixed-indexed annuities.

Indexed annuities offer their owners, or annuitants, the opportunity to earn higher yields than fixed annuities when the financial markets perform well. Typically, they also provide strong protection against market declines. While indexed annuities are linked to the performance of a specific index, the annuitant won't necessarily reap the full benefit of any rise in that index. One reason is that indexed annuities often set limits on the potential gain at a certain percentage, commonly referred to as the "participation rate." The participation rate can be as high as 100%, meaning the account is credited with all of the gain, or as low as 25%. Most indexed annuities offer a participation rate between 80% and 90%—at least in the early years of the contract.

Participation in the marketplace, protection from loss, and a lifetime income stream that you can never outlive. It's time to stop investing like a teenager! Speak with one of our retirement experts today!

Over 30 Years of Industry Experience..

Michael Cubell is a proud affiliate Advantage Life and Health, which has served thousands of seniors and trained hundreds of agencies nationwide. With rock-solid resources, a commitment to top-tier customer service, and the backing of an industry giant, we are confident in our ability to deliver the services our community requires! We are proud to serve and will continue to do so with your partnership for many years to come!

Over 30 Years of Industry Experience..

Michael is the owner of Triangle Life and Health, which has years of experience helping seniors locally as well as nationwide. With rock-solid resources, a commitment to top-tier customer service, and the backing of an industry giant, we are confident in our ability to deliver the services our community requires! We are proud to serve and will continue to do so with your partnership for many years to come!

Michael Cubell

Triangle Life and Health

Agency Owner

(919) 689-6565

mike@trianglelifeandhealth.com

Contact Us..

Schedule a call with our office..

Michael Cubell

Owner / Michael Cubell

Employee #2

Title

(919) 689-6565

mike@trianglelifeandhealth.com

Copyright Triangle Life and Health@2026. All Rights Reserved.

Copyright Michael Cubell @2026. All Rights Reserved.